Just How To Receive Auto Financings

https://money.usnews.com/money/personal-finance/saving-and-budgeting/articles/how-to-prepare-for-food-inflation-as-prices-rise -Bright Pugh

Prior to obtaining a vehicle loan, you must recognize what to expect. The needs vary depending on the loan provider, but your basic list must include your existing earnings and also identity evidence. You also need to provide your financial institution statement. Besides your earnings, loan providers likewise consider your debt-to-income (DTI) ratio, which is the ratio of your month-to-month repayments to your revenue. The ratio needs to not exceed 50%; some lenders might enable a lower DTI. Whether you get a financing depends upon a variety of variables, yet these are generally the primary ones.

The quantity you obtain largely relies on your credit report. The greater your credit score, the better. Making use of a third party to fund your Auto loan might suggest a reduced month-to-month repayment. But you need to also consider that your APR might be higher than anticipated, specifically if you have poor credit rating. Fortunately, there are ways to lower your APR. By filling out a single application, you can receive multiple deals from various loan providers.

Bankrate thinks about 18 elements when choosing the most effective Auto lendings. These include price, deposit requirements, availability in your state, and also client service. In addition to these factors, the client experience likewise plays a vital role. It makes up such points as ease of access of customer care, availability of autopay, as well as openness. When shopping for a car financing, keep in mind to compare rates and also fees and also select the most effective deal possible. As well as bear in mind, you can always pay the funding back later on.

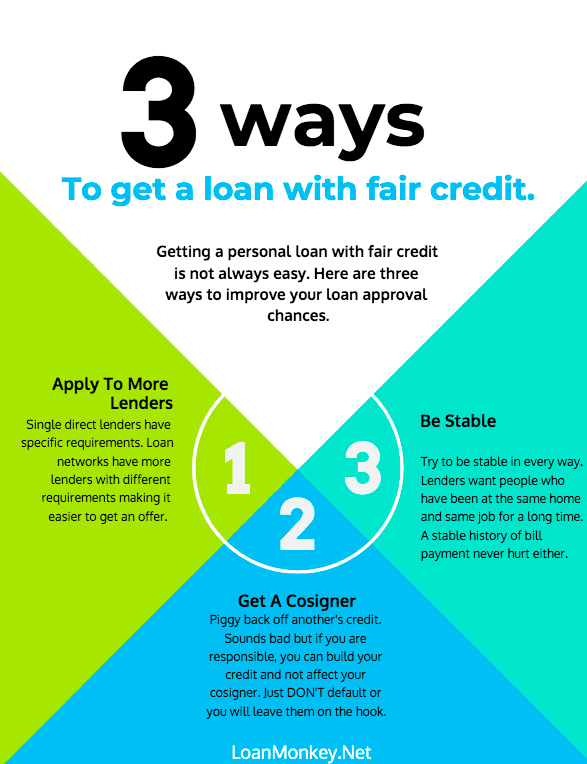

To obtain the very best bargain, choose a short-term Auto car loan with the lowest interest rate. Although a 60-month term may appear reasonable, it will certainly cost you numerous dollars in rate of interest. Additionally, an older lorry will have extra problems and will deserve much less cash over time. Long-term finances are riskier for lenders, and so their rate of interest will be higher. This is why it is a good idea to get a cosigner if you have good credit scores.

Finally, select an auto that fits your budget plan. Try to save up for a large deposit before looking for an automobile funding. A twenty to thirty percent down payment will decrease your monthly settlement as well as help you get approved for a reduced rate of interest. Likewise, think about a co-signer, who will take complete responsibility if you back-pedal the car loan. By complying with these tips, you need to be able to fund your new lorry. And also bear in mind: negotiating your rate of interest will save you money in the future. You can also negotiate the rate of your new cars and truck as well as the funding strategy.

The size of the lending is an additional vital consideration. You can choose a car loan with a greater rate of interest if you have the methods as well as can afford the greater monthly payments. However, the longer the lending term, the greater the rates of interest. Nonetheless, it will save you cash in the long run given that your concept balance will be spread out over a longer time period. A much shorter finance term will certainly allow you to settle the car loan with minimal trouble.

When selecting a lorry, the kind of funding you look for need to be based upon your credit rating. Unsecured finances are not safeguarded, so you can use your vehicle for anything you desire. If you're preparing to pay off the finance early, a guaranteed Auto lending may be right for you. Along with your credit score, you must be aware of the regards to the loan so you can make the best choice. But before obtaining an automobile finance, make certain to look around to find the ideal one for you.

If you have good credit rating, you can make the most of pre-approval lendings from your financial institution. They can provide you a pre-approved funding in the form of a blank check to get a new or previously owned cars and truck. Prior to obtaining a financing, you'll need to provide basic individual info, including your income, the type of vehicle you're seeking, as well as for how long you prepare to pay it back. Additionally, make sure to determine the price of ownership as well as insurance policy to make sure that the financing will not hurt your credit history.

Once you have actually identified your budget plan, you can start looking for a car funding. Take into consideration a down payment and regular monthly settlements. Having https://guaranteedautoloansbc.tumblr.com/ is a great way to guarantee you can pay for a cars and truck without scamming other requirements. One more means to lower the regular monthly repayment is to trade in your existing cars and truck to reduce the total amount. Ideally, consider placing a deposit on the automobile you want, however keep in mind that monthly payments on a brand-new automobile shouldn't go beyond 10% of your gross income.